The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them. A contribution margin analysis can be done for an entire company, single departments, a product line, or even a single unit by following a simple formula. The contribution margin can be presented in dollars or as a percentage.

Variable Costs

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Get in Touch With a Financial Advisor

The concept of this equation relies on the difference between fixed and variable costs. Fixed costs are production costs that remain the same as production efforts increase. Variable costs, on the other hand, increase with production levels. The contribution margin helps to easily calculate the amount of revenues left over to cover fixed costs and earn profit.

Sales Revenue

The contribution margin is important because it gives you a clear, quick picture of how much “bang for your buck” you’re getting on each sale. It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all. It’s also a helpful metric to track how sales affect profits over time.

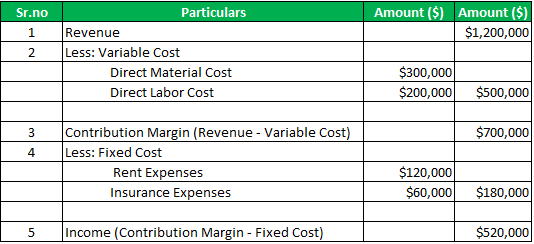

It can also be an invaluable tool for deciding which products may have the highest profitability, particularly when those products use equivalent resources. In general, the higher the contribution margin ratio, the better, with negative numbers indicating a loss on every unit produced. For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. how to calculate contribution per unit Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line.

- So, it is an important financial ratio to examine the effectiveness of your business operations.

- For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s.

- Using this formula, the contribution margin can be calculated for total revenue or for revenue per unit.

- In other words, it measures how much money each additional sale “contributes” to the company’s total profits.

When to Use Contribution Margin Analysis

A good contribution margin is all relative, depending on the nature of the company, its expense structure, and whether the company is competitive with its business peers. Find out what a contribution margin is, why it is important, and how to calculate it. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. Barbara is a financial writer for Tipalti and other successful B2B businesses, including SaaS and financial companies. She is a former CFO for fast-growing tech companies with Deloitte audit experience.

For instance, you can make a pricier version of a general product if you project that it’ll better use your limited resources given your fixed and variable costs. Consider its name — the contribution margin is how much the sale of a particular product or service contributes to your company’s overall profitability. It’s how valuable the sale of a specific product or product line is. In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement.

The contribution margin ratio of a business is the total revenue of the business minus the variable costs, divided by the revenue. It also results in a contribution margin ratio of $14/$20, or 70%. From this calculation, ABC Widgets learns that 70% of each product sale is available to contribute toward the $31,000 of total fixed expenses it needs to cover each month and also help achieve its profit target. The contribution margin tells us whether the unit, product line, department, or company is contributing to covering fixed costs.

The higher the number, the better a company is at covering its overhead costs with money on hand. The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue. Now, divide the total contribution margin by the number of units sold. Thus, it will help you to evaluate your past performance and forecast your future profitability.

Comments